- #1

vantz

- 13

- 0

Hello,

How is

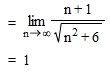

Taking the derivative on the top and bottom makes it go in circles

Thank you

How is

Taking the derivative on the top and bottom makes it go in circles

Thank you

Derivatives are financial instruments that derive their value from an underlying asset, such as stocks, bonds, commodities, or currencies. They can be used to manage risk, speculate on price movements, and generate returns.

Derivatives work by creating a contract between two parties that specifies the terms of the underlying asset's future performance. This contract can be bought and sold, allowing investors to take a position on the asset's price without actually owning it.

There are several types of derivatives, including options, futures, forwards, and swaps. Options give the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price. Futures and forwards are contracts to buy or sell an asset at a future date at a specified price. Swaps involve exchanging one asset for another, such as exchanging fixed-rate payments for variable-rate payments.

Derivatives can be highly risky, as they involve predicting the future performance of an underlying asset. There is a potential for large gains, but also for significant losses. Additionally, the use of leverage in derivatives trading can amplify the risks.

Derivatives are widely used in the financial markets for various purposes, such as hedging against price fluctuations, speculating on market movements, and managing risk. They are also used by companies to mitigate risks associated with their business operations, such as currency exchange rate fluctuations.