- #1

- 2,038

- 1,124

Hi everyone. As you may know, I had previously started a discussion regarding poverty rates among Millennial households in the US (see the link here for those who may not be familiar).

https://www.physicsforums.com/threads/more-millennial-households-in-the-us-are-in-poverty.936087/

After reviewing the thread and having talked about this with others, I've come to realize that the discussion that I initiated (certainly my entries in the thread) were not up to the standards that I personally would subscribe to. So with the kind help of @russ_watters , I've decided to re-launch the discussion here.

Intro

I thought I'd point out some disturbing news related to the Millennial generation (those born in 1980 and afterwards) in the US:

Fact(S) to be Discussed [1]

http://www.pewsocialtrends.org/2011/11/07/chapter-2-income-poverty-employment/

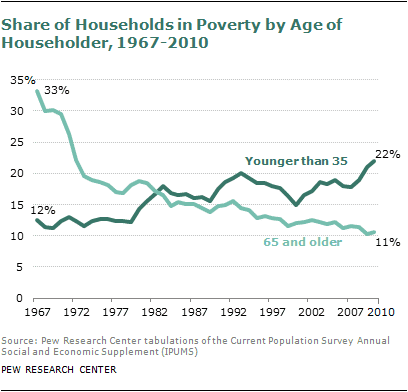

Over time, more of those in the younger generations (under 35) are in poverty even as the older generations (over 65) have been improving. 30 years ago, the poverty rate for these groups was about equal at 17% whereas today the poverty rate among millennials is 22% and the poverty rate for baby boomers is about 11%. There is a lot of related contextual information in the multi-page article linked and I encourage everyone to read at least the page linked, on income, poverty and employment rates for more insight.

Analysis of the Facts

The graph shows long-term, continuous decline in the standard of living of young people that cannot be explained away as temporary due to the Great Recession or caused by “lazy millennials”.

Extension/Prediction

This shows permanent injury to millennials that will in the future reverse the trend of improving standard of living for older people, causing millennials to spend their entire lives at lower standards of living than their predecessors.

Reaction

What is striking is how this is not causing greater alarm with the broad fabric of American society that the younger generation has fewer opportunities for advancement and are living in poverty.

https://www.physicsforums.com/threads/more-millennial-households-in-the-us-are-in-poverty.936087/

After reviewing the thread and having talked about this with others, I've come to realize that the discussion that I initiated (certainly my entries in the thread) were not up to the standards that I personally would subscribe to. So with the kind help of @russ_watters , I've decided to re-launch the discussion here.

Intro

I thought I'd point out some disturbing news related to the Millennial generation (those born in 1980 and afterwards) in the US:

Fact(S) to be Discussed [1]

http://www.pewsocialtrends.org/2011/11/07/chapter-2-income-poverty-employment/

Over time, more of those in the younger generations (under 35) are in poverty even as the older generations (over 65) have been improving. 30 years ago, the poverty rate for these groups was about equal at 17% whereas today the poverty rate among millennials is 22% and the poverty rate for baby boomers is about 11%. There is a lot of related contextual information in the multi-page article linked and I encourage everyone to read at least the page linked, on income, poverty and employment rates for more insight.

Analysis of the Facts

The graph shows long-term, continuous decline in the standard of living of young people that cannot be explained away as temporary due to the Great Recession or caused by “lazy millennials”.

Extension/Prediction

This shows permanent injury to millennials that will in the future reverse the trend of improving standard of living for older people, causing millennials to spend their entire lives at lower standards of living than their predecessors.

Reaction

What is striking is how this is not causing greater alarm with the broad fabric of American society that the younger generation has fewer opportunities for advancement and are living in poverty.